Optimism Amongst EtA Investors

"The Evolution of Entrepreneurship Through Acquisition," Chicago Booth’s most recent EtA research paper overviews the search industry, from its origins to its current landscape. The paper touches on topics such as historical rates of return, common acquisition structures, the changing profile of the entrepreneur, and alternative forms of EtA.

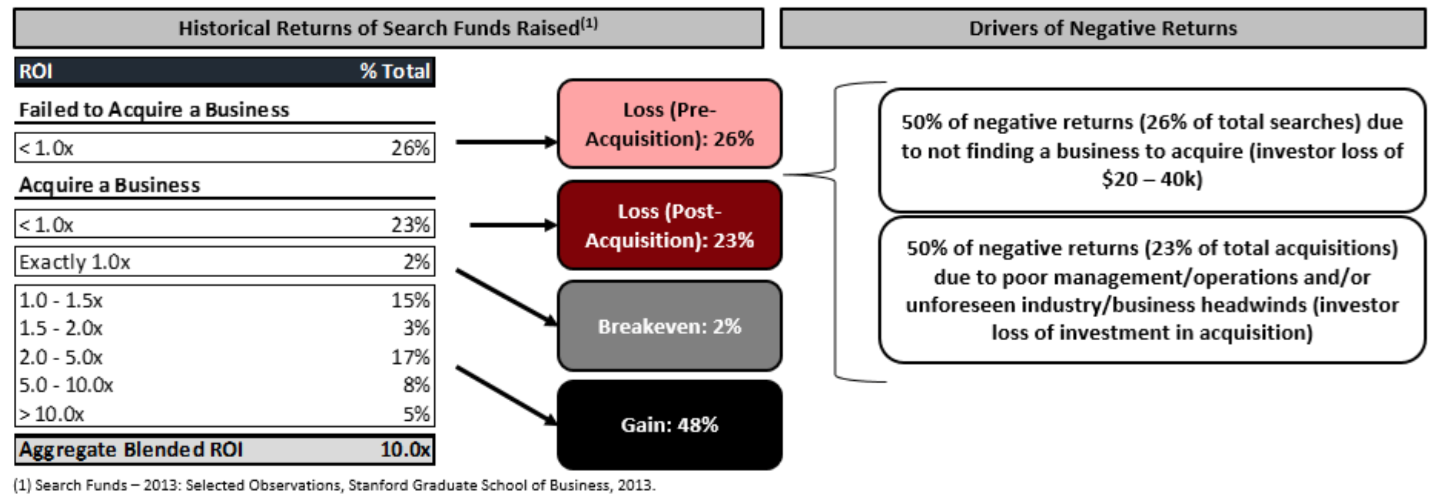

“Since inception, the traditional search fund model has generated a cumulative IRR of 34.9% and ROI of 10.0x (this data is from search funds raised between 1983–2013, according to Stanford GSB). These data account for 177 total search funds raised, of which 32 were still searching at the time and 11 had other/unknown outcomes. Of the remaining 134 search funds, 99 (74%) had successfully acquired an operating company.”

“Investors are optimistic about ETA for many reasons. Chief among them is the pool of available small businesses and the aging American demographic, which combine to create an extremely attractive opportunity for entrepreneurship through acquisition.

“One interesting observation is that searchers appear to be heavily influenced toward certain models based on which school they attend. For example, Stanford students tend to choose the traditional search fund route, likely because so many of the faculty and alumni are still actively involved in that community. HBS searchers tend to self-fund; more alumni have chosen that route and prominent faculty encourage it. We expect both these trends to have major impacts going forward.”

Download the full report HERE.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.