Small Business Acquisition vs Traditional Path: The More Profitable Route for MBAs

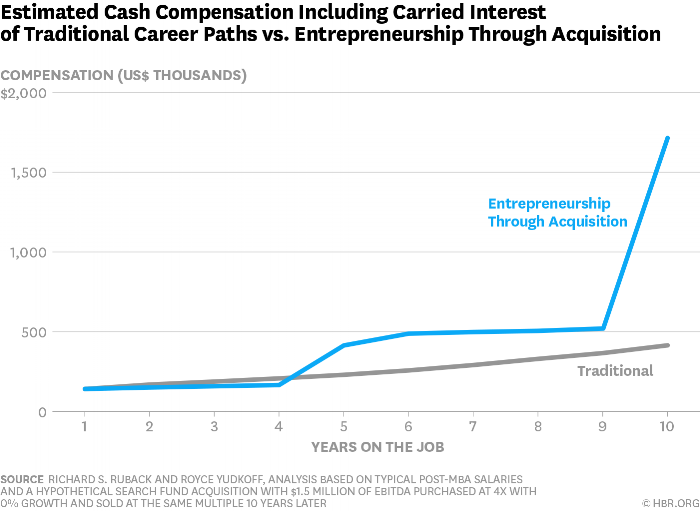

A recent Harvard Business Review article by Richard S. Ruback and Royce Yudkoff compares compensation between MBAs who choose to purchase an existing small business to own and operate with MBAs pursuing a traditional path such as banking or consulting.

The article assumes the average starting salary of graduates from elite MBA programs is about $150K, growing "at a 12% compound annual growth rate (CAGR) so that it more than triples in the first 10 years, which is in line with post-MBA salary surveys we’ve done here at the Harvard Business School" It also assumes "the cash compensation for a new CEO of a small business starts off at the average post-MBA salary, and its growth is generally tied to the performance of the company..."

Ruback and Yudkoff find, "The advantage to the traditional path in the early years is very much offset by the impressive EtA cash flows that occur once the carry starts getting paid and even more so upon exit (which we’ve assumed in year 10 in this example)." View their comparison below.

Read Richard S. Ruback and Royce Yudkoff's full article in the Harvard Business Review.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.